In recent years, the world of finance has seen a dramatic shift as retail investors have collectively come together in approaches that were previously impossible. One of the most outstanding examples of this movement is Superstonk, a network that originated on Reddit and became a major player in the money markets. What began as an institution of traders discussing unmarried inventory has become an all-out economic phenomenon that has attracted the attention of Wall Street, regulators and the media.

This article dives deep into the origins of Superstonk, how it gained momentum, and why Superstock has such an effective push inside the international currency. We’ll reveal the key events that brought Superstonk into the limelight, the impact it had on the markets, and what fate it might hold for this particular community.

About the origin of the Superstalk

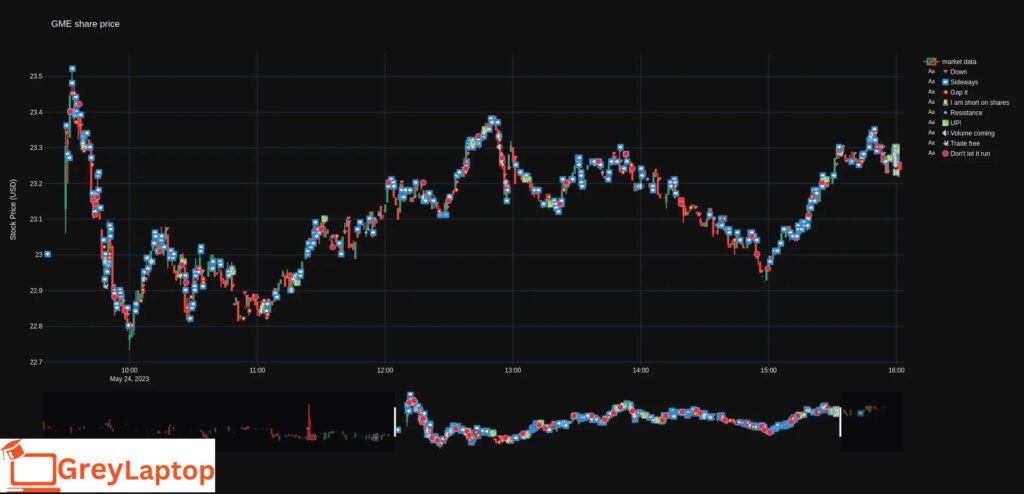

To understand Superstonk, we must first go back to the beginnings of the short GameStop (GME) saga. In early 2021, a collection of retail buyers on Reddit’s WallStreetBets subreddit discovered that GameStop, a struggling video game store, had an unusually excessive level of short hobbies. Hedge funds and institutional investors weighed heavily in opposition to the corporation, believing its stock price would stand to say no.

However, retailers at WallStreetBets noticed the possibility. They believed that if enough human beings bought GameStop stock, they could put pressure on a short squeeze, which would increase inventory levels and cause significant losses to the hedging budget, which had limited inventory. The concept quickly caught on, and as more shoppers flocked to GameStop, the stock price skyrocketed to levels no one had anticipated.

In the midst of this madness, a new subreddit was born: Superstonk. This network was created to be aware of GameStop in particular and the wider ramifications of rapid compression. As the movement gained momentum, Superstonk became a place for marketers to move to for proportional studies, speaking techniques, and songs about the latest developments within the GameStop saga.

Rise of the Superstalk

As Superstonk grew, it attracted numerous organizations of people, from amateur traders to experienced investors. What distinguished Superstonk from various economic groups was its emphasis on deep research and analysis. Superstonk members began digging into GameStop’s finances and uncovered data that suggested the agency was unfairly focusing on fast sellers.

One of the major turning points for Superstonk was the invention of the “naked short promo” concept. Naked shorting occurs when an investor sells a stock without honestly borrowing it to sell. This practice is illegal in many jurisdictions. However, this has changed with the belief that several hedge funds did this to drive down GameStop’s stock price. The Superstock network took this information and used it to recruit more investors to their cause.

As the movement took off, Superstonk became a hub for people who believed in GameStop’s turnaround ability. The chain coined the term “diamond guns” to describe individuals who were committed to holding on to their GameStop stock despite fluctuations in the stock price. The phrase became a rallying cry for Superstock, symbolizing the networks’ determination to take on Wall Street.

Superstock’s impact on the markets

Superstock’s upward pressure has had a profound impact on financial markets. A quick squeeze of GameStop in January 2021 turned into a simple start. As the stock price soared, it sent a shock wave through Wall Street. The hedge spread that bet against GameStop was pressured to cover its short positions, resulting in billions of dollars in losses.

The completion of the Superstock proposal additionally stimulated comparable campaigns targeting other heavily shorted stocks, together with AMC Entertainment and BlackBerry. These campaigns came to be called “meme sharing” because they were pushed out using internet memes and social media hype. The Superstonk community played an essential function in these efforts, using their studies and evaluations to perceive rapid capacity.

In addition to boosting stock prices, the Superstock movement also brought greater scrutiny of Wall Street practices. Regulators and lawmakers have begun scrutinizing the position of hedge funds, market makers and brokers in the GameStop saga. The activities surrounding Superstonk have raised questions about market manipulation, the fairness of the financial instrument and the energy dynamics between retail investors and institutional players.

The cultural impact of Superstock

In addition to the monetary effect, Superstonk also had a large cultural impact on. This proposal gave a voice to retail buyers who had long felt marginalized by using the cash system. For many individuals at Superstonk, it became more than just making money – it became approximately difficult for the glory quo, and the fight returned in opposition to a device they believed had turned into a manipulated hardship for the rich and powerful.

Superstock’s language and imagery have become part of popular culture. Expressions such as “diamond arms”, “to the moon” and “HODL” (for expensive lifestyles, keep going) have become widely identified symbols of the movement’s ethos. Superston participants embraced the experience of camaraderie and shared purpose and saw themselves as part of a larger war against Wall Street.

This cultural shift has also spread to the media. The GameStop saga and the rise of Superstonk received huge coverage in the mainstream press, with headlines depicting a David and Goliath story of retail buyers taking over Wall Street. Documentaries, podcasts, and even books have been made about this phenomenon, in addition to capturing the nearness of the Superstonk on record.

Key events in the Superstonk saga

The Superstonk movement is characterized by the use of several key activities that shape its trajectory. These moments are now not the most difficult to describe by the community, but they additionally have a permanent effect on the economic markets.

- January 2021 Short Press: GameStop’s early January 2021 quick press was the catalyst for the introduction of Superstonk. As inventory costs soared, they forced hedge funds to cover their short positions, leading to heavy losses and drawing attention to the sector.

- The Robinhood Controversy: In late January 2021, the popular buying and selling app Robinhood restricted trading of GameStop stock and other memes due to concerns about market volatility. The permit sparked outrage among Superstock members who took notice as they tried to defend Wall Street at the expense of retail buyers. The controversy sparked calls for more transparency and accountability within the cash machine.

- Congressional Hearings: In February 2021, the US Congress held hearings to investigate opportunities related to GameStop’s short squeeze. Key figures from Superstonk, as well as executives from Robinhood, Citadel and other financial institutions, testified before lawmakers. The hearings highlighted the power of the Superstock movement and the wider implications of the retail investor revolution.

- AMC Stock Rise and More Memes: After fulfilling GameStop’s short squeeze, Superstonk participants have become interested in various closely shorted stocks along with AMC Entertainment. These campaigns further demonstrated the effects of the Superstock network and cemented its popularity as a force to be reckoned with in the economic markets.

- Continuing the fight against naked short selling: Superstonk maintains a reputation for uncovering and debunking instances of naked short selling. The network has made it their mission to preserve hedging spreads and hold various financial institutions accountable for their actions and advocate for reforms that save you from market manipulation.

The future of Superstock

Looking to the future, the Superstock movement shows no signs of slowing down. While the preliminary frenzy around GameStop may have subsequently died down, the community remains alive and engaged. Superstonk has progressed directly into a wider movement that transcends any single inventory, with individuals persistently researching and debating a wide range of financial topics.

One important challenge for Superstock could be maintaining momentum and focus. As with any movement, there may be the possibility of dilution as new contributors join and the community expands. However, Superstonk’s central concepts – deep research, transparency and a determination to challenge the financial status quo – are likely to carry over.

The effect of Superstonk Superstock on money business is also likely to be long term. This movement has already brought about better scrutiny of market practices and a greater focus on the power of retailers. Regulators and lawmakers will have to grapple with the results of the Superstock phenomenon, especially as it relates to market value and investor safety.

More: Reddit

Conclusion

In short, Superstonk is much more than just a subreddit or a group of buyers – it’s miles away an economic phenomenon that has changed the way we think about considering markets, power and participation. From its beginnings in a short GameStop squeeze to its ongoing efforts to expose market manipulation, Superstonk has proven that small investors can have a huge impact on money gadgets.

As the Superstock community continues to evolve, its impact will likely extend beyond the financial sector and serve as a symbol of the dynamics of conversion in society as a whole. Whether you’re a seasoned investor or new to the markets, the story of Superstalk is a testament to the energy of a collective movement and the ability of normal people to give credit to the status quo.